In order for this article to make sense to those of you who haven’t read the first installment of this 2-part series, it would be wise to read this and this first.

It was an interesting and fun week for me, having the $50k Challenge to contend with in addition to my higher-priority personal and professional responsibilities. Needless to say, I had to put my usual Seeking Alpha contributions on hold, as the week simply would not permit. I’d like to start off by saying: Woo-hoo!  I did it, and then some (the picture is a gag intended for the good man who put me up to the task). I managed to crank out a 10.3% return on my initial total investment amount in less than four days. You’ll see what I mean. [By the way, Ian…I choose Morton’s and I think I’ll go for the surf and turf and indulge myself in some well aged single-malt.]

I did it, and then some (the picture is a gag intended for the good man who put me up to the task). I managed to crank out a 10.3% return on my initial total investment amount in less than four days. You’ll see what I mean. [By the way, Ian…I choose Morton’s and I think I’ll go for the surf and turf and indulge myself in some well aged single-malt.]

Now that I’ve got that bit out of the way, I feel like a little weight has been lifted from my shoulders. I can only hope that those that followed along with me on my mini-journey can appreciate my willingness to take on such a challenge in such a public way. I should probably thank Seeking Alpha for providing such a dynamic platform, in which I was able to use an article, its instablog feature, its convenient stocktalks forum, along with Twitter and LinkedIn (LNKD) to provide near real-time updates in my public effort to use roughly $50,000.00 of my cash reserves to book a 7.5% return in one week’s time.

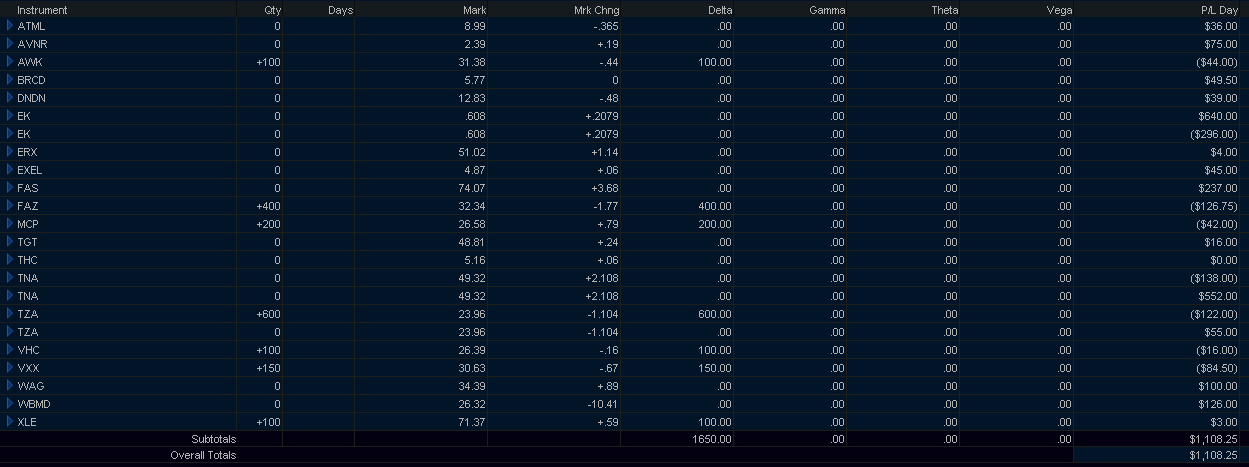

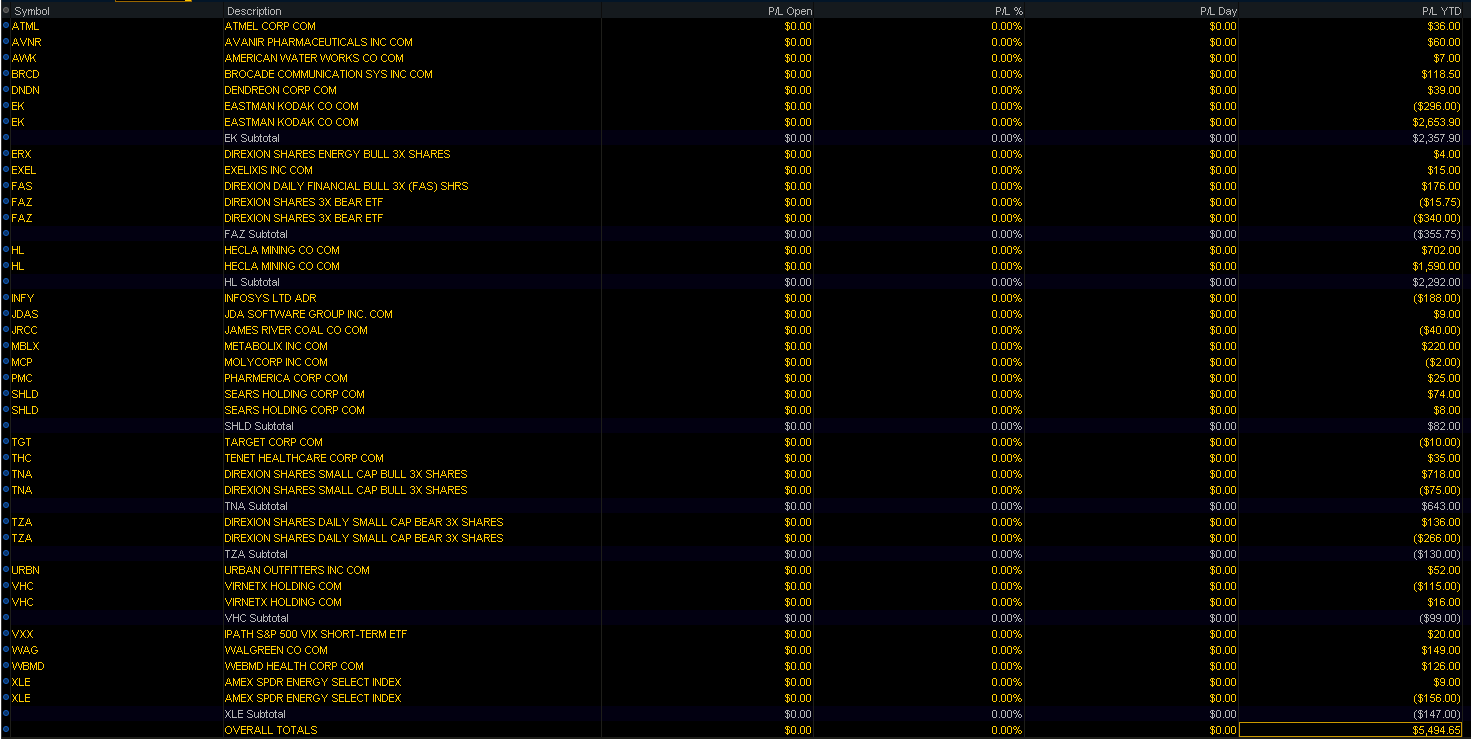

Below is a list of all of the companies and corresponding ticker symbols I played this week:

Equities: Non-active (19)

WebMD Health Corp. (WBMD), Atmel Corporation (ATML), Avanir Pharmaceuticals (AVNR), American Water Works Company, Inc. (AWK), Brocade Communications Systems, Inc. (BRCD), Dendreon Corporation (DNDN), Exelixis, Inc. (EXEL), Infosys Limited (INFY), JDA Software Group, Inc. (JDAS), James River Coal Company (JRCC), Metabolix, Inc. (MBLX), Molycorp, Inc. (MCP), PharMerica Corporation (PMC), Sears Holdings Corporation (SHLD), Target Corporation (TGT), Tenet Healthcare Corporation (THC), Urban Outfitters, Inc. (URBN), VirnetX Holding Corporation (VHC), Walgreen Co. (WAG)

ETFs & ETNs: Quasi-active (7)

Direxion Daily Small Cap Bull 3X Shares (TNA), Direxion Daily Small Cap Bear 3X Shares (TZA), Direxion Daily Financial Bull 3X Shares (FAS), Direxion Daily Financial Bear 3X Shares (FAZ), iPath S&P 500 VIX Short-Term Futures (VXX), Energy Select Sector SPDR Fund (XLE), Direxion Daily Energy Bull 3X Shares (ERX)

Equities: Actively utilized trading vehicles

Eastman Kodak Company (EK) and Hecla Mining Company (HL)

Below, you will find a day-by-day summary of my five day trade-fest. I must warn you that Monday’s log was a complete disaster, as I put $50k to work, for the better part of the day, only to end up down $35.00.

Dow v. Me (for days 1-4, the snapshots were taken within a minute or two of the regular session closing bell, so they may be slightly off due to post-closing-bell extended hours fluctuations):

Click to enlarge images

Day 1: Dow up 0.29% – My portfolio down about 0.07%

Day 2: Dow up 0.56% – My portfolio up about 2.18%

Day 3: Dow down 0.10% – My portfolio up about 2.88%

Day 4: Dow up 0.17% – My portfolio up about 3.12%

Day 5: Dow Down 0.39% – My portfolio up about 2.26%

Dow on the week: Up 0.5%.

Me on the week: Up 10.3%

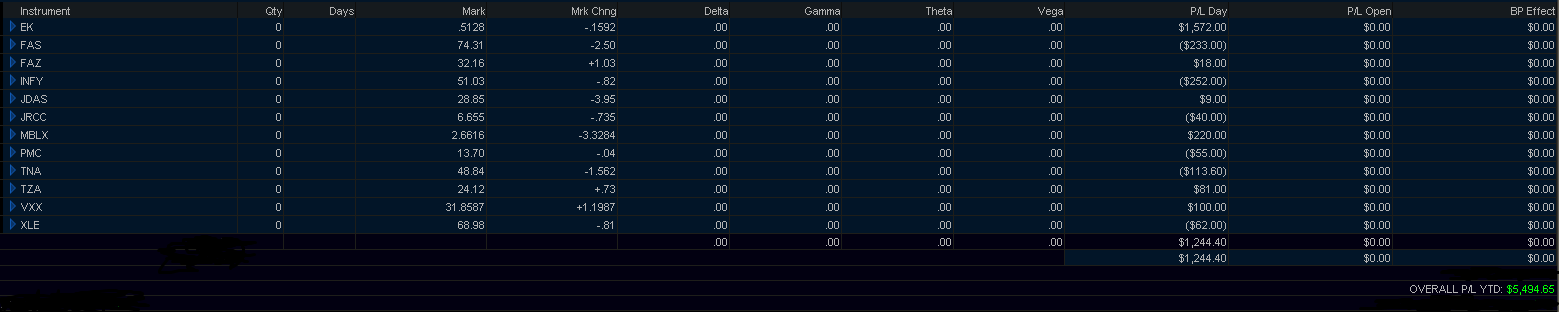

Total P/L on the Week: +$5,494.65

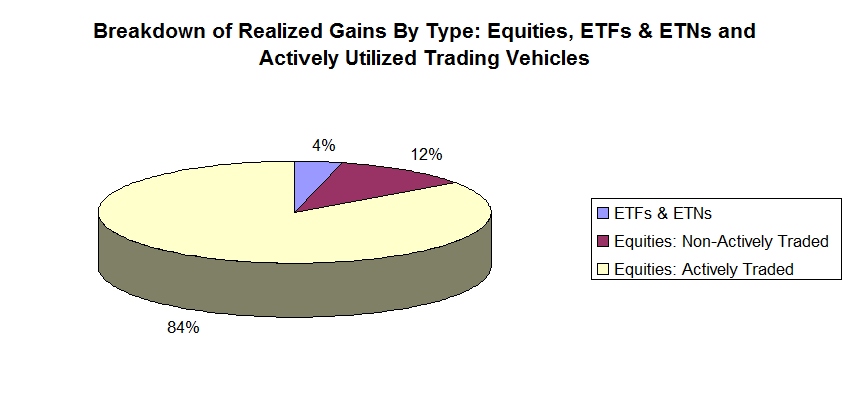

Breakdown of Profit by Type:

Click to enlarge

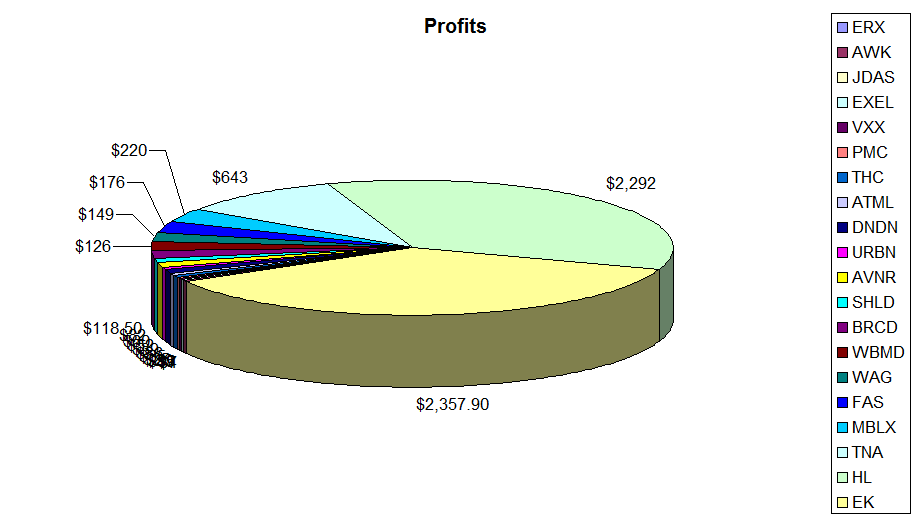

As you can clearly see, the overwhelming majority of my gains came from heavy trading of just a couple of extremely volatile equities that, combined, accounted for roughly 68% of all of my trades for the week. Heading into the week, I expected that approximately 65% of any gains would come from the ETFs and ETNs. Boy, was I wrong. If I hadn’t picked up on trading patterns, I may well be writing a very different follow-up article right now. Fortunately, I am not.

I am not a market timer. I am more of a pattern recognition specialist and I find great pleasure in beating the machines. In this situation, with this particular portfolio, I had to keep things as simple as possible (again, due to other more pressing responsibilities). So I started the week with a handful of equities and other financial instruments that my scans showed a higher probability of moving up than most others. Many of them were gone and forgotten about by Tuesday. As promised, after my sad display on Monday, my trading activity and productivity picked up dramatically through the week.

I made my hay between Tuesday and Thursday, as I maintained my discipline and held to my overall strategy. Because of this, there was a natural progression / increase in daily gains. This is simply because of an age old truth: the more money you have to put to work, the more money you can make off of it. Being that I reached my 7.5% goal on Thursday, I had to create a new one. As I mentioned in my instablog, I am a big believer in setting goals in writing, for how can one expect to get somewhere if they don’t yet know where they are going? On Friday, I had to cut the day short by about 2 ½ hours because I had to pick up my sick son (again, my fault), so progressive increase came to an end there.

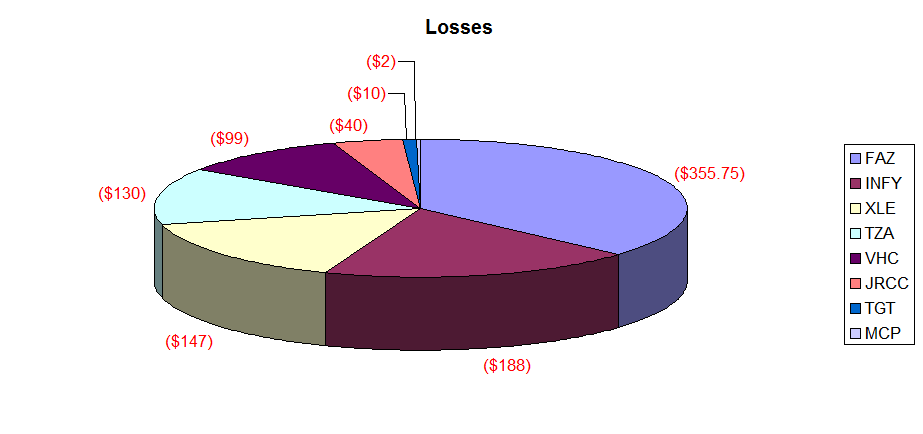

Leaving Eastman Kodak (EK) and Hecla Mining (HL) out of the discussion for the moment– and on top of moving in and out of the ETFs and ETNs with relative success– for the most part, I scanned the markets for and bought oversold equities that were, at the time, highly volatile and trading on several times their regular volume with relatively high betas that had “bounce back” or “drift up” potential. Though I was still slightly positive on the week with those particular equities, that part of my simple overall strategy yielded less than desirable results.

For most of the week I left myself positioned for the following day properly with ETFs and ETNs, with the only real exception being Friday, where I was looking for 1%+ gains across all three major U.S. indices and was positioned for a bull run. What I got was the not-as-good-as-expected JP Morgan Chase (JPM) earnings and EU credit rating downgrade reports. Nonetheless, I kept my cool and found a way to etch out a positive day before having to call it a week. I had no interest in falling short of my secondary objective of achieving a 10% gain.

All in all, it was an interesting and stimulating exercise, but I am not overly impressed with the end result, as I turn those kind of numbers with some regularity. Since I had fun during the week and received so many supportive messages and well wishes via Twitter, Seeking Alpha, e-mail and LinkedIn, I have decided to further the good will and positive energy by donating half of the post-tax proceeds to a multiple sclerosis charity that I have a long history with.

I think my next challenge will be one that I put to myself: Achieve a 20% weekly gain using only ETFs and ETNs. This is mostly because I am somewhat disappointed in my results from trading them in this challenge. I am still in the process of trying to analyze where I went wrong with them this past week.

That ends the exhibition. I hope that it kept some of you entertained and, more importantly, I hope that the exhibition and articles have been of benefit to at least one of you.

As always, happy trading, never fall in love with a stock and leave the emotion at the door.

Source: Seeking Alpha